South African real estate startup Instant Property has secured an undisclosed amount of funding from Cape Town-based venture capital firm HAVAÍC to continue to scale both locally and internationally.

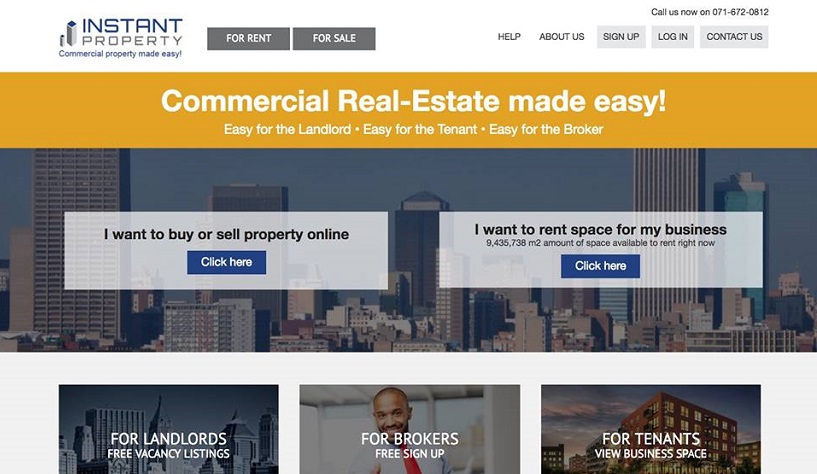

The Johannesburg-based Instant Property has developed a highly customised technology solution for leading commercial and residential property organisations in South Africa, which includes specialised mobile apps, websites and integrated CRM platforms, alongside big data and analytics reporting tools.

HAVAÍC, which advises and invests in early-stage, high-growth businesses, has acquired a 10 per cent equity stake in the commercial property platform, and also has the option of an allocation for follow-on funding which would take its stake up to 17 per cent.

“We are fortunate to already service a wide variety of clients including Nasdaq and JSE-listed real estate entities, to commercial and residential brokerages wanting to enhance their businesses bottom line through technology without the heavy cost and complications of having an in-house technology team,” said Instant Property founder and executive chairman Wayne Berger.

“We searched long and hard for a partner in South Africa who understands the venture capital sector as well as shared our ambitious vision for Instant Property and the investment has come at the perfect time as we continue to scale up the business both locally and internationally.”

HAVAÍC’s executive director Grant Rock, formerly at Zenprop and Bowmans, has joined the Instant Property board.

“We are very excited to be partnering with Instant Property who are pioneers in the online commercial real estate sales, rentals and auctioning space,” said Rock.

“In recent years we have seen significant investment in this space both from existing players as well as international investors and believe that the Instant Property marketplace is the missing link in a sector that is ripe for disruption.”