Mobile and online car insurance brokerage platform AutoGenius.com is looking to disrupt the insurance market in Nigeria, aiming to see all of the country’s estimated 12 million uninsured cars insured via the platform.

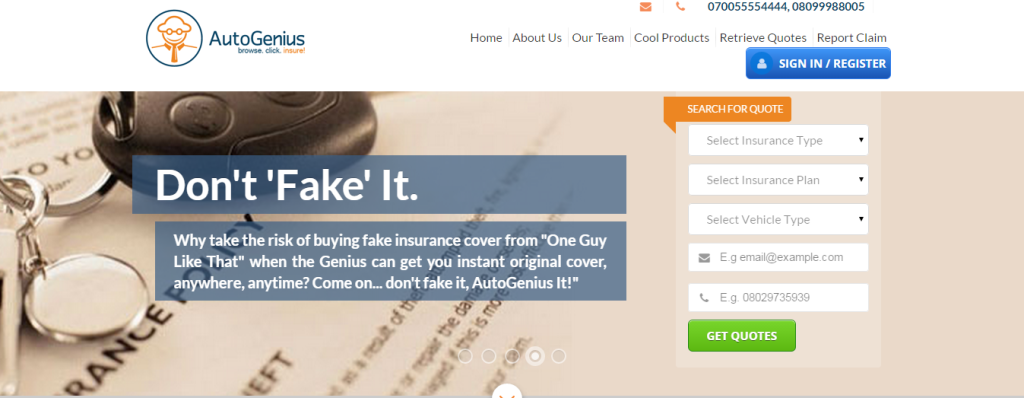

Speaking to Disrupt Africa, Gbenro Dara, co-founder and chief operations officer (COO) of AutoGenius says the Nigerian car insurance market to date has been hindered by public perceptions as well as tedious and unreliable offerings. In particular, he says long processes to purchase an insurance package, and an active fake insurance industry, have suppressed the market.

“Ordinarily it takes sometimes up to a week of back and forth visits to an insurance company to get an authentic insurance cover,” Dara says.

“There are approximately 12 million cars going about either uninsured or with insurance policies purchased from “one guy like that” – a common phrase in Nigeria used to refer to a random source,” he explains.

AutoGenius.com is looking to tap into this vast unserviced market, by providing a quick and simple platform – accessible online or via a mobile device – where users can search for insurance packages meeting their needs, get quotes, and compare packages. Users can then buy their favoured package via the platform, and receive instant SMS official confirmation from the authorities guaranteeing the authenticity of the product purchased.

“AutoGenius allows users to buy a policy from the comfort of their homes or offices as quickly as within five minutes for a third party insurance, and within 24 hours for other policies,” Dara says.

“The same thing has been done in the area of claims settlement. We have so far been able to achieve a 100 per cent claims settlement by our underwriters. Claims processed via AutoGenius are paid within seven working days,” he says.

According to Dara, insurance is one area in which technology can have a transformative impact on the market, both in terms of providing consumers with relevant products, and in terms of simplifying the whole purchasing process.

“An effective use of technology can drastically improve on the entire insurance offering. By being able to gather sufficient data to develop the kind of products that people need, and also to improve on service processes by streamlining or automating where need be,” Dara says.

Launched in October 2014, the startup has already racked up over 10,000 users on its platform, and lists products from five of Nigeria’s top insurance providers – with more to be added in the coming months.

“Our users vary widely from the typical young upwardly mobile individuals who are already used to shopping online and the internet savvy 60 year old grandmother, to the taxi driver who is excited about being able to check his insurance validity on the National Insurance Industry Database via SMS,” Dara says.

For now, Dara says the startup is focused entirely on satisfying the Nigerian market – which he says presents huge opportunities.

“We are driven by our mission of insuring every car in Nigeria one at a time. Our expansion plans are hinged on our ability to totally satisfy the customer throughout the lifetime of his/her policy. The opportunity for growth within Nigeria is very huge. For now our focus is Nigeria, and on rolling out the innovative products in our pipeline to serve its teeming population,” he says.