SpacePointe is pleased to announce the launch of PointePay – a mobile point of service platform – into the Nigerian market. With pilot launches in several states across the country, PointePay has been designed especially for micro, small and medium enterprises (MSMEs) in emerging markets like Nigeria. The drive for financial inclusion has given rise to a specialised and service oriented mobile point of sale that is designed for the informal sector.

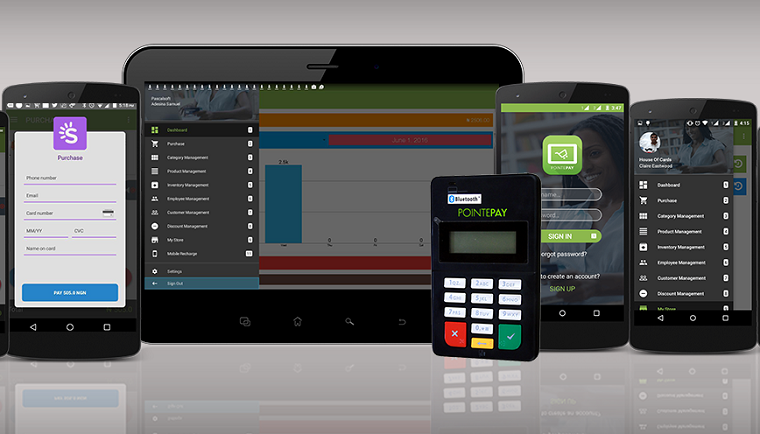

PointePay enables MSMEs to completely manage their businesses online and in-store, providing them with an end-to-end service offering for their customers. It’s more than a point of sale: It’s the new “Point of Service”. With PointePay, MSMEs are able to showcase and sell their products online. They are also able to sell their products in-store using multiple types of payments.

The majority of businesses in the Nigerian market fall into the MSME category and further still are considered part of the informal sector. Getting them to transact online involves provisioning solutions into the market like PointePay that enable:

- Financial Inclusion: MSMEs need to be banked to enable settlement. Easy access to their funds is crucial to adoption.

- Affordable Solutions: Selling a card reader with a mobile point of sale application is only going to work for a small section of the market that can afford it. PointePay is the first fully mobile application launched into the Nigerian market that includes the informal sector as it relates to pricing and features. With less than US$6 upfront and a US$3 monthly fee, the MSMEs are finding the pricing much easier to swallow.

- Available Solutions: Electronic payment solutions must be available to these merchants as well. Pushing an MPOS solution that is only available on smartphones in Nigeria for example creates a barrier to entry for over 70 per cent of merchants. With PointePay, merchants will be able to collect cashless payments even with the use of a feature (USSD) phone.

- Inclusion-Inspired Features: Textual and Computer literacy challenges for example present barriers to adoption for the informal sector. SpacePointe continues to innovate around the needs of this demographic with features like audio navigation in multiple languages. A micro retailer with the press of a button on his app is able to get guidance on how to use PointePay in his native language.

This is not a one-man show. SpacePointe is partnering with key players in the industry such as banks, payment networks, payment providers and telcos to enable features on PointePay that will drive meaningful adoption for the critical masses. With these partnerships SpacePointe is able to get these MSMEs banked (if they are not already banked) and get them transacting online in a simple way.

SpacePointe is a MasterCard payment facilitator and is able to handle micro settlements to these MSMEs. With PointePay, MSMEs are also able to become mobile money (wallet) load centers for banks and wallet payment providers because of the in-built fraud management features. This solves a lot of the mobile money fraud problems that providers have faced in trying to utilize this demographic as load centres.

SpacePointe has won multiple awards since the 2014 DEMO Africa win of the top-five technology startups in Africa. Recent wins include the West African Mobile Award in the Retail and Commerce Category and the latest CBN Cashless Card Award of the 2016 Best Cashless Merchant.

Other market launches planned for 2016 include South Africa, Uganda, Zambia and Tanzania.