South African fintech company TaxTim has launched a company tax return tool to broaden its service for small local businesses.

Founded in 2011 with seed funding from Google by Evan Robinson and Marc Sevitz, TaxTim allows users to file their tax returns online with step-by-step guidance.

In March the digital tax assistant raised an undisclosed amount of funding from the newly formed innovation unit of South African financial services group MMI Holidays, Exponential.

The new addition to its service sees TaxTim provide provisional and annual tax return services for businesses registered Pty Ltd with the Companies and Intellectual Property Commission (CIPC) and that make less than ZAR1 million (US$74,000) in revenue for the tax year.

A TaxTim survey of small business owners in South Africa found 58 per cent of owners managed the books of their company themselves, with the majority not having any formal training. Only 13 per cent utilised the services of an outsourced professional.

The startup said this data validated the decision to provide an affordable service for small business owner-managers without extensive accounting and tax knowledge, allowing them to complete their company tax returns correctly and confidently.

“When we started this venture, our vision was to transform the tax return process for all taxpayers. The individual market was a natural starting point and I looked forward to the day that we would release services for businesses too. It’s exciting to see that come to fruition,” said Sevitz.

TaxTim is a gold member of AlphaCode, the Rand Merchant Investments (RMI) club for fintech startup entrepreneurs. Dominique Collett, RMI’s senior investment executive and head of AlphaCode, said SMEs have traditionally been underserved by financial services firms, hence the value of TaxTim.

“We think this is an exciting development from TaxTim as small business owners really need empowering tools like this to enhance their business productivity. We particularly like how TaxTim approaches a daunting topic like tax by simplifying the process and engaging the user digitally,” she said.

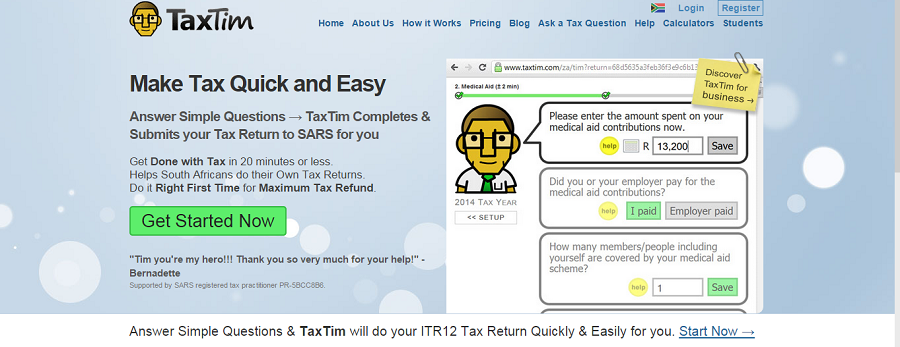

Like the individual tax return service, TaxTim’s conversational approach guides users through the company tax return step-by-step, without the need to understand technical accounting and tax terms. Questions are presented in a logical order in plain English and, where necessary, linked to pre-formulated calculators or tools.

These calculators and tools allow users to determine whether the business qualifies as a Small Business Corporation (SBC), calculate depreciation values on various assets or equipment, work out whether certain expenses are tax deductible, and calculate complex asset disposals to ensure accurate capital gains or losses are recorded.

As the user responds, TaxTim records the answers and, once completed, presents the results with all incomes, expenses, allowances, calculations and deductions filled in the correct place on the ITR14 document and checked for accuracy and compliance. All that remains is for the taxpayer to copy the information across into the SARS-generated ITR14 document on eFiling and submit their return.