Zambian agri-tech startup Zazu has pivoted into the digital banking space as it looks to solve the problems with moving money in Africa.

Launched in October 2015, Zazu originally allowed farmers with extra produce to connect with new markets, while buyers are provided with a more sophisticated and easy way to order more produce for less. It launched operations in Zambia earlier this year.

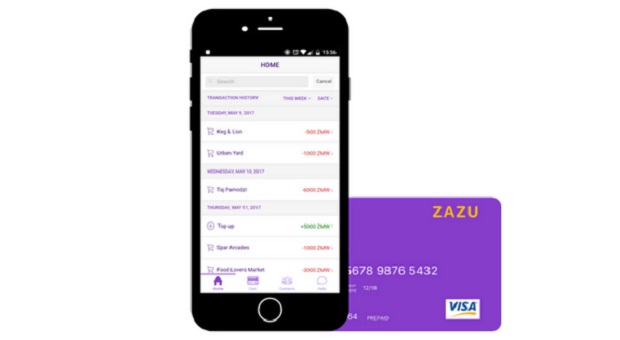

However, based on issues the startup has encountered in recent months, it has now pivoted into the fintech space and plans to launch a digital bank over the course of this year. In September it will launch 1,500 prepaid debit cards, and in November will roll out Zazu Pay, which will allow merchants across Zambia to accept digital payments.

By January 2018 it hopes to have received a banking licence from the Bank of Zambia. Founder and chief executive officer (CEO) Perseus Mlambo told Disrupt Africa the company had made the decision to pivot based on its experience of making and receiving payments.

“We got engaged by a client to move money for them on a regular basis and in the course of doing research about the finance industry, we actually came up with a better product. You read about it everywhere: over 330 million people have no access or use financial services. That is both a staggering statistic and the biggest call to action,” Mlambo said.

“It’s allowed to continue like that because very few working class can be bothered to engage with a system they feel is not meant for them. The rising middle class have no patience to spend hours in a queue and genuinely, people hate being charged to access their own money.”

Zazu, therefore, has simplified the KYC process when registering an account, and removed account operating fees. But Mlambo said the biggest feature it is building is a bank that tells you instantly how much you have at that exact moment.

“The hope and evidence so far is showing that the more you see where you are spending, the more in control you are of how to actually go about with saving. Within the app, people have the option to actually stash money away and force themselves to save,” he said.

Though he said it would be premature to start looking at scale right now, he said problems around payments were not just Zambian or event African.

“We are issuing the first set of accounts in September and we are working on ensuring it goes extremely well. Along with a private raise, we are having a crowdfunding raise coming up in the next few weeks, of which we are in pre-registration for anyone interested in owning a piece of Zazu,” said Mlambo.