Zambian fintech startup Zazu has secured GBP166,000 (US$218,000) after running an oversubscribed crowdfunding campaign on Seedrs in order to launch a digital bank.

Launched in October 2015, Zazu originally allowed farmers with extra produce to connect with new markets, and launched operations in Zambia earlier this year.

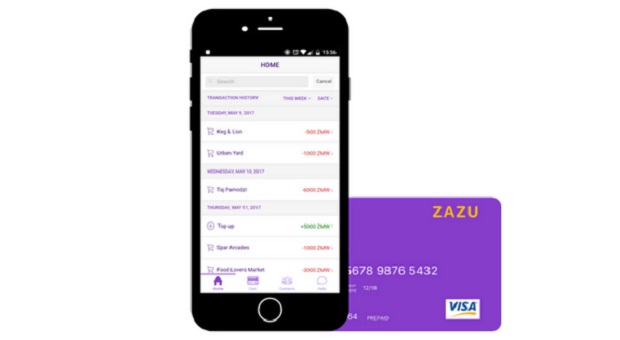

However, the startup announced in July it had pivoted into the digital banking space as it looks to solve the problems associated with moving money in Africa. It plans to launch 1,500 prepaid debit cards, and will also roll out Zazu Pay, which will allow merchants across Zambia to accept digital payments.

In order to finance this, the startup ran a crowdfunding campaign on Seedrs, which is already oversubscribed even before its close. Zazu was seeking GBP150,000 (US$197,000), and has already raised GBP166,353 (US$218,000) in return for 6.32 per cent equity.

Zazu’s aim is to secure 100,000 users in Zambia by 2018, with the funds raised to be used for a controlled launch in the short to medium term.

“From the onset, Zazu was never meant to be just a Zambian product, but for now this investment round will be used to ensure that our product responds to the feedback we have been getting from thousands of people currently waiting for a Zazu card,” Zazu founder and chief executive officer (CEO) Perseus Mlambo said.