South African e-health startup RecoMed has raised ZAR4.5 million (US$324,000) in funding to fund a shift to increasing product traction and market its products and services.

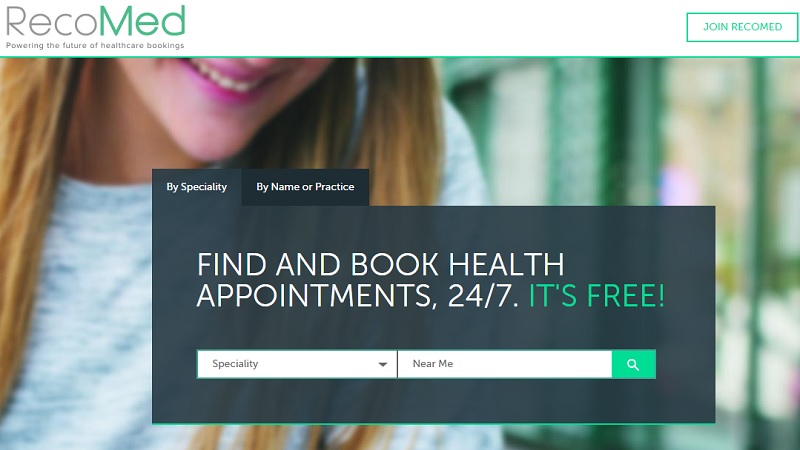

RecoMed is an online healthcare marketplace, enabling consumers to easily book appointments with a diverse group of healthcare providers 24/7, who in turn benefit from increased patient traffic and practice efficiencies.

The investment was secured by investment and advisory firm HAVAÍC, the ASISA Enterprise Development Fund, and Growth Grid Venture Capital Partners. The ASISA ESD Fund was an early investor in RecoMed, and has increased its equity participation with this new round.

Two-thirds of the funding will be utilised in the immediate term, with the rest to be drawn at RecoMed’s request within six months of the initial draw down. RecoMed will use the funds to strengthen the balance sheet, fund a shift to increasing product traction and towards marketing its products and services.

The startup’s short-term objectives are to complete several new integrations with leading industry healthcare software systems while steadily growing its current clientele base of 1,400 practitioners, and to double monthly bookings to 40,000 per month.

“While we exist in a complex ecosystem with massive potential, traction takes time. It’s extremely encouraging to see RecoMed’s adoption by most of the big players in the healthcare space, even in these early days,” said Sheraan Amod, chief executive officer (CEO) of RecoMed.

Ian Lessem, CEO of HAVAÍC, said his company’s desire to lead an investment in RecoMed is the result of how impressed it had been by the quality of the company’s product and leadership.

“The company has seen off a wide range of domestic competitors because of its focus on developing a platform that really works. We look forward to seeing RecoMed cement its reputation as the market leader in the industry,” he said.