“There are more than enough investors out there, which wasn’t the case just a few years ago.”

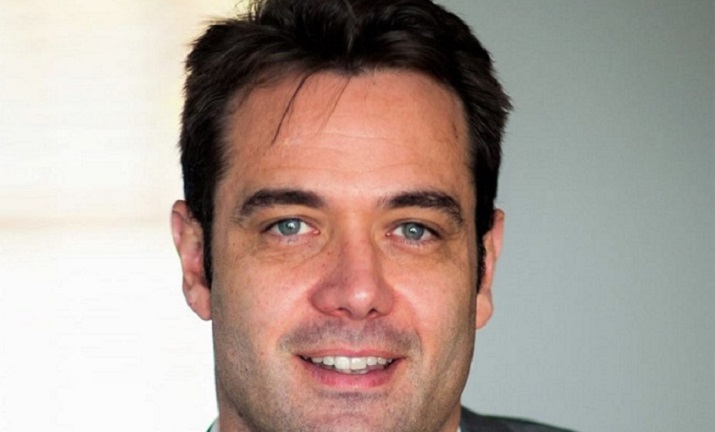

Many African tech startups won’t totally agree, but it seems D’Neil Strauss thinks a little differently than your average investor.

South African Strauss worked in the management consulting and private equity industries before starting Stocks & Strauss with business partner Wayne Stocks in 2013, initially as a vehicle to invest in high potential, early-stage entrepreneurs.

“The initial focus was to invest in early-stage startups, but we soon realised that emerging markets do not have the same rules as developed markets when it comes to raising follow-on rounds of equity funding for our startups,” he said.

“The amount of time and effort required from investors in early-stage startups is also much more intensive than when investing in later stage companies.”

Stocks & Strauss decided to pivot, focusing on profitable companies with the potential to grow. It has since invested in the likes of HealthCloud, Digital HQ, WAPP and Digemy, and Strauss said he and Stocks “feel more comfortable in this space”. There are big plans for this year.

“2018 will be a year of expanding our portfolio in cashflow-positive companies and to assist our current portfolio companies in dipping their toes into blue ocean opportunities to diversify on an even deeper level,” he said.

Strauss said Stocks & Strauss is a permanent capital structure, not a fund.

“The initial capital was invested by the founders and as we continued to grow, a group of very close associates approached us to invest and we gave them the opportunity to increase our pool of capital,” he said.

“We are constantly approached by investors to participate in the expansion of Stocks & Strauss and we may decide to raise funds in the holding company when the timing is right.”

The company is industry agnostic, but has some very specific criteria, which stemmed from its previous good and bad investment experiences. These criteria include a certain level of profitability in the previous financial year, recurring revenue with defensible barriers to entry, short or no working capital cycle, no more than two current shareholders, and an ambition to grow and become a leader in a specific market or niche.

“I realise that these criteria may seem difficult to attain, but these companies are out there, and we have the tools to take them to the next level,” Strauss said.

The focus is on South Africa, with Stocks & Strauss planning to expand its geographic footprint through the growth of its portfolio companies, rather than investing directly in other countries.

“While we do have investments in other geographical areas, we believe that there are tremendous opportunities in South Africa at the moment, especially when considering the networks and synergies between our current portfolio companies,” Strauss said.

“We have found that it is extremely difficult to maintain a portfolio of companies in another country unless you have a dedicated team on the ground that you can trust completely. We are currently expanding one of our portfolio companies aggressively into Africa and believe that the opportunities are out there, but it is certainly not easy.”

In his view, some African startups lack realism, while others lack ambition.

“The ones that lack realism are constantly dreaming while reading tech blogs from Silicon Valley. They attempt to raise funds on a dream and an idea with no tangible revenue or proof that they can turn revenue into profit,” Strauss said.

“On the other hand, we find that another group of African startups dare not even dream about their own potential to become leaders in their field. The ones that succeed are the ones who find a good balance between realism and big dreams.”

He said startups could always use more assistance, but added there has been improvement in the ecosystem on a constant basis due to support from policymakers.

“I have invested in other markets where there is too much assistance from policymakers and a new breed of “grant”-preneurs arose, that are unable to survive without government grants,” Strauss said.

“So, while the push for entrepreneur friendly policies must continue, we should always remember that the hardships that we are facing now, is exactly what will make us more competitive in a global economy in years to come.”