The payments space in Angola is getting a much-need shake-up, as the country gets its first comprehensive mobile wallet courtesy of local startup Kamba.

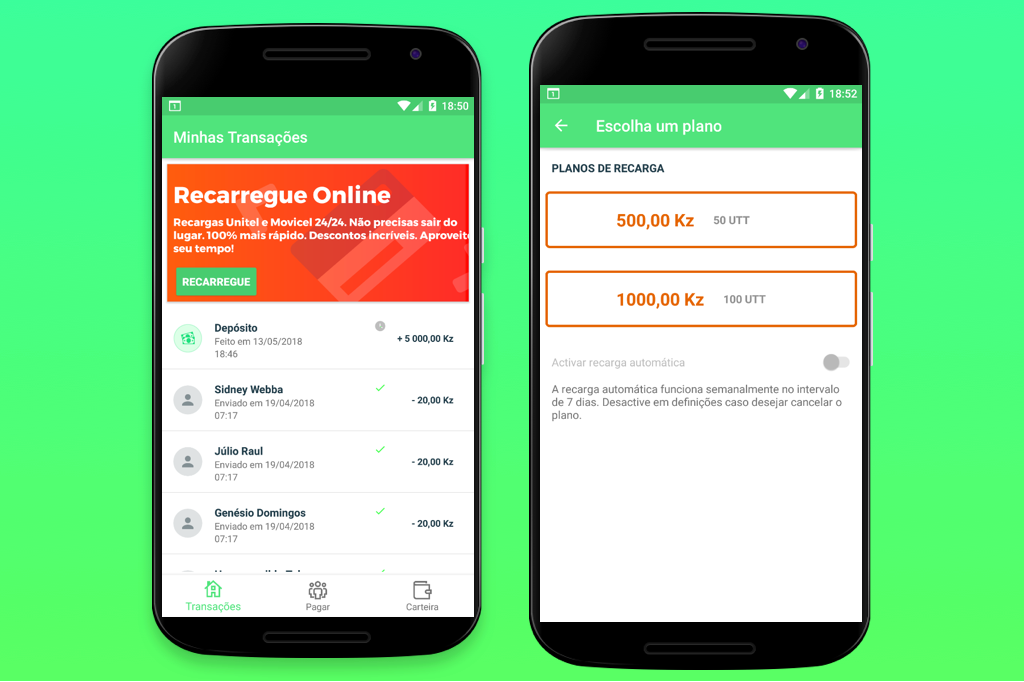

Launched in April this year, Kamba allows users to send and receive money to other individuals within the app or via QR code free of fees, as well as to pay for utilities, and a range of services and products online and in-store.

While only 29.3 per cent of adult Angolans have access to banking services, according to the World Bank, to date there has been no efficient service available to Angolans to make mobile or online payments for goods and services – prompting the launch of the mobile app which the Kamba team says represents a “huge step forward compared to traditional means”.

“The reality of payments in Angola is very different from other African countries. People struggle to have access to cards, and payment services on the internet don’t exist. Currently, there is no efficient solution to purchase goods and services over the internet in Angola, so Kamba is bringing an innovative experience, access to financial services and uncomplicated way to purchase goods and services over the internet, all without a card,” says Kamba co-founder Amarildo Lucas.

Since launching in April, Kamba has seen over 200 users register, as well as signing up 23 partner merchants accepting payment via the service.

“Last week we launched online mobile recharges integrated with the main mobile operators in Angola for the first time,” Lucas says.

Kamba wants to empower Angolans to reap the benefits of tech solutions, and to enable them to become active in the digital economy.

By the end of the year, the startup plans to launch a public API to developers and merchants in Angola, allowing them to receive payments via QR code or online with a payment gateway.

But for now, Lucas says the first priority is to continue onboarding customers, and signing up more partners – from ATM providers to cinema ticketing services – to ensure a streamlined flow across transactions.

“The biggest barriers to cashless adoption in a cash-reliant country like Angola are infrastructure and currently no company is doing a great job in this sector. So while the country continues to look for a way to go cashless, Kamba is leading the way with an effective and out-of-the-box solution,” Lucas says.