Impact investors in Africa can “have their cake and eat it” when it comes to marrying doing good with sizeable returns on investment.

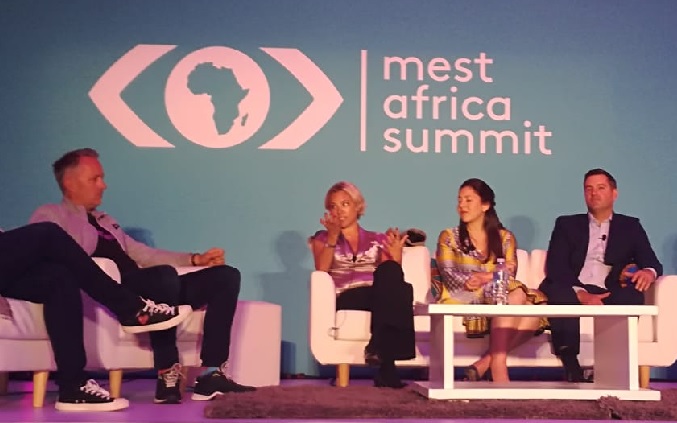

That is according to Eva Dimitriades, chief operating officer (COO) of CS Accelerate, who was speaking during a panel discussion on “for-profit impact” at last week’s MEST Africa Summit in Cape Town.

“I believe that you can have your cake and eat it. It is all about driving social, environmental and economic impact all together,” she said.

Anders Lier, chief executive officer (CEO) of Nordic Impact, the company behind the Oslo-based Katapult Accelerator, agreed.

“I believe that the greatest challenges of this planet represent the greatest opportunities. There is a strong correlation between doing good and making money, so there is no tradeoff in the impact investing space. We can make much more money than traditional investors,” he said.

The last few years have seen a shift away from traditional non-profit, aid models on the continent to more sustainable, profit-driven models, a development the panellists welcomed.

“I have often thought what Africa might look like today had the more than one trillion dollars that has come in in aid been used to allow people to borrow money or start their own businesses. It is so telling that so many of the issues have not vanished as a result of aid, or are worse,” said Bridgit Evans, managing director of the SAB Foundation.

“Looking at it more from an investment point of view than an aid point of view, it empowers people and gives them control over their own destinies. There is so much talent on this continent. We need to empower businesses that can grow.”

But what is “impact”? Lier said Nordic Impact was very agnostic when it comes to this.

“When you are early-stage investors like us you need to look for intentions. We know these companies may change their approach and their business model, so we focus a lot on the intention part of the founders,” he said.

Evans agreed intention was at the heart of the question.

“For us, it is very intentional. We have a whole dropdown list and it is things like health, education, water, sustainable livelihoods. It must be about innovative ways of tackling particular issues within the country and beyond. It must be very intentionally trying to solve a particular social problem,” she said.

Evans noted that this must go beyond simply job creation, a view shared by others.

“Job creation is quite a shortsighted outcome. You could set up a sweatshop in Bangladesh and employ 100,000 people but if you are overworking and underpaying them, is it a net positive impact? It is about considering the ripple effect and every single thing you are doing,” said Dimitriades.

How companies measure their impact is also an important question, but this varies case-by-case and sector-by-sector.

“You can measure impact in so many ways, there is no standardised way,” said Dimitriades. “Impact is not static, it has a long tail.”

When it comes to creating impact, huge numbers of startups in a number of spaces are tackling a variety of problems. There is a lot of duplication, as demonstrated by recent Disrupt Africa reports on the fintech and agri-tech spaces on the continent, but Dimitriades said she didn’t think this was a bad thing.

“Competition should be embraced, and everyone has a different way of tackling the problem. Yes, you are going to have a lot of agri-tech companies that are trying to ensure there are more transparent supply chains. One is going to start in Kenya, one in Zimbabwe, another in Mexico. That’s fine. They’re all going to have a different journey and get to the top,” she said.