Nigerian fintech startup TeamApt has been awarded a switching licence by the Central Bank of Nigeria (CBN) which will help AptPay, one of the startup’s products, to provide financial solutions to different customer segments.

Launched in 2015, the Lagos-based TeamApt was formed to solve inefficiencies in Nigeria’s growing digital financial services market, at scale, using automation, and has deployed over 55 tailored solutions to 26 African banks, including 100 per cent of Nigeria’s commercial banks.

Disrupt Africa reported in February the startup closed a US$5.5 million Series A funding round to help it scale into new markets, and it has now secured the highest level of licence awarded to any fintech by the CBN, one that allows it to aggregate banks and debit their banking positions via the central bank.

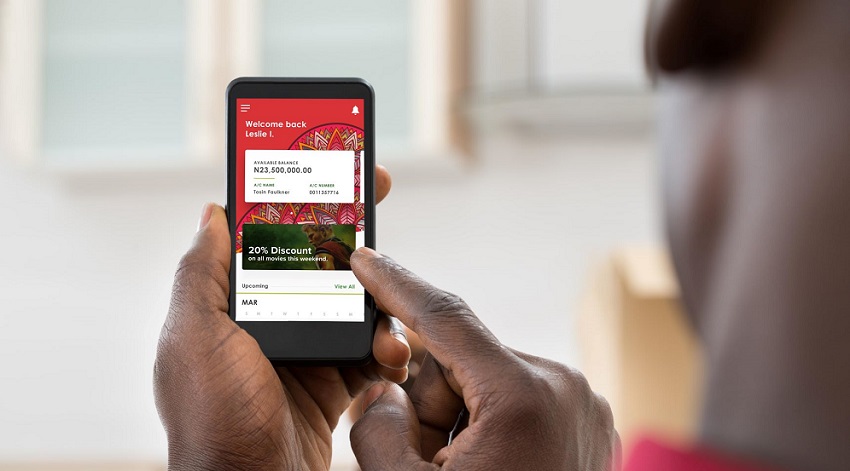

“What this translates to is that with AptPay, TeamApt can actually move money across the banks without putting our money down. This licence puts TeamApt on the same level as other Tier-1 financial technology companies,” said TeamApt chief executive officer (CEO) Tosin Eniolorunda.

“If through a payment gateway, a buyer pays a merchant for a product and the payment gateway provider needs to pay the merchant instantly, without the licence, the provider will have to pay with its own money. But with the licence, the provider is merely moving the bank funds around without tying down its money.”

Dumebi Duru, the team lead for AptPay, which is a robust payment infrastructure powering payment processing, inter-bank transfers and direct debits, describes the switching licence as the “last piece to the matrix”.