Nigerian lending startup Kudimoney has rebranded to Kuda and received a banking licence from the Central Bank of Nigeria (CBN) in preparation of the launch of a full service digital bank.

Launched in 2016 and a participant in last year’s Startupbootcamp AfriTech accelerator programme, Kudimoney has until now been focused on loans.

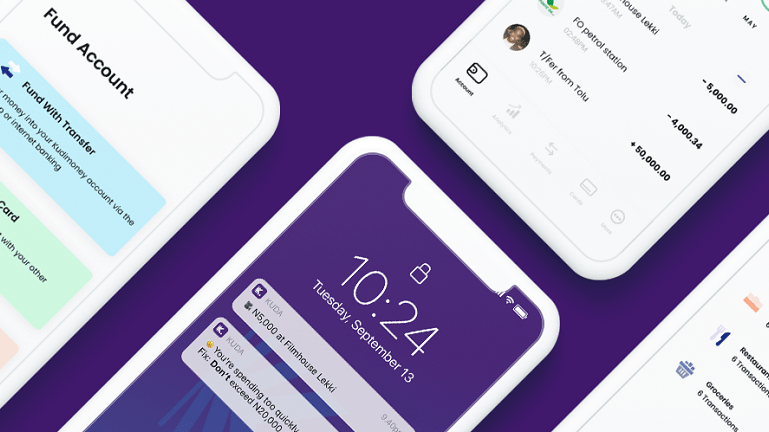

However, the startup is following a continental trend of fintech startups rebundling the bank with its rebrand to Kuda in light of receiving a microfinance banking licence from CBN. The new platform will offer digital-only, no-fee banking services, targeted at Nigerian millennials. Kuda members receive a debit card, a spending and savings account, and an app that keeps them in control of their finances at all times.

“We’re excited to usher in a new era in consumer banking and serve the many Africans, who we believe are frustrated with traditional banks,” said Babs Ogundeyi, co-founder and chief executive officer (CEO) of Kuda.

“Starting with Nigeria, we’ll launch a new kind of bank with a continued focus on improving our members’ financial lives rather than trying to burden them with hidden fees and excessive charges.”