Kenyan fintech startup Tanda is working to revolutionise access to essential goods and financial services for micro-retailers through its digital platform.

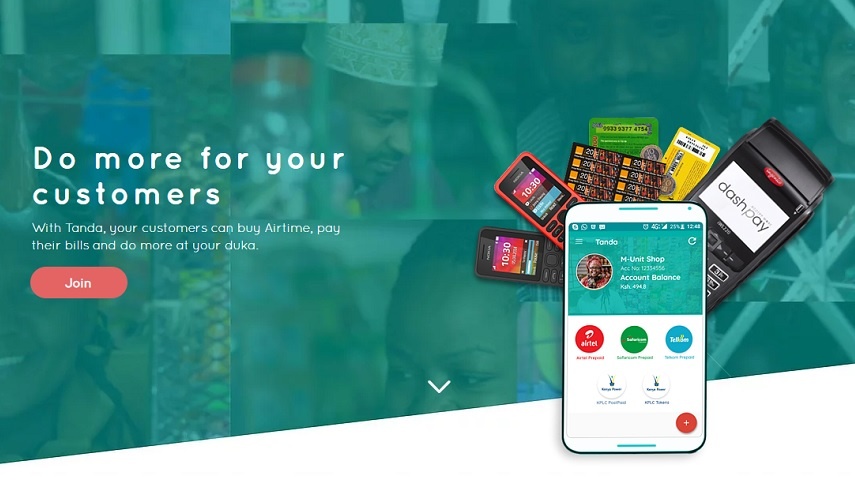

Founded last year, Tanda allows shop owners to access inventory on credit, and also become access points for essential services such as airtime, utility payments, banking and insurance services for their customers.

The platform aggregates all major financial services providers, allowing agents to vend various digital products, while it also delivers essential goods to shops. Tanda also extends unsecured credit to its agents.

“For the longest time, shopkeepers have been the cornerstone for African communities,” said Geoffrey Mulei, Tanda’s chief executive officer (CEO). “Despite being the preferred financial services vendors by most consumers, many still face barriers to becoming agents, routinely struggle to get consistent supplies to their shop due to unreliable suppliers, and do not have any credit history nor access to financing.”

Tanda fixes all this. It allows merchants to sign up to become bank and mobile money agents, and also handles inventory management and fulfillment. Merchants can buy from local wholesalers, and also do so on credit. For Mulei, the whole thing is personal.

“I spent a large part of my childhood working as a shopkeeper’s assistant. This gave me a front row seat to a day in the life of a shop owner,” he said.

“I witnessed from a very early age how important shopkeepers are to African neighbourhoods and some of their challenges. This inspired me to start thinking about solutions for my shopkeeper and the millions more like her across the continent.”

What began as a passion project has gradually developed into a business. Tanda rolled out a pilot in January 2018 after raising US$250,000 funding from White Rhino Ventures, and officially launched in June. It is now in the market for a further US$500,000 funding to expand aggressively across East Africa

“We have seen excellent customer validation through sales in financial services for amounts over US$350,000, and have won substantial market share with about 7,000 agents across Kenya. We recently raised a loan book and, through the pilot, we are optimistic about the lending product’s performance,” said Mulei.

“We currently have a footprint in all major towns in Kenya and are preparing to rollout a pilot in Kampala, Uganda. After we close on our current round, we plan to expand aggressively in Kenya, with a target of 70,000 agents in 18 months. While are also rolling out pilots in Tanzania, Rwanda, Zimbabwe and Cameroon.”