Nigerian fintech startup Trove has secured an undisclosed amount of equity funding from asset management firm ARM to help it deliver access to global investment opportunities.

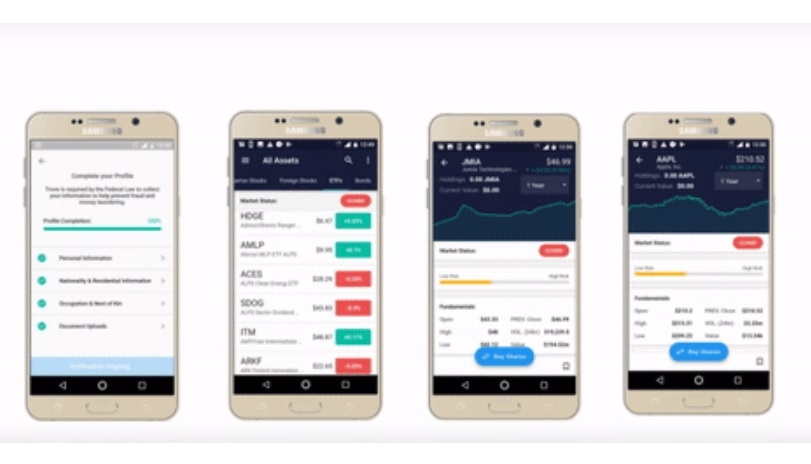

Trove has built a simple micro-investing app that allows users to invest in financial securities such as stocks and government bonds in Nigeria and in international markets such as the United States (US).

The startup’s platform was built to solve issues around the accessibility of securities investment, and allows Nigerians – and soon all Africans – to participate in the global economy and buy shares in international firms.

Earlier this year, Nigerian asset management firm ARM partnered Ventures Platform, a Trove investor, to launch its Labs by ARM programme, focused on supporting startups utilising technology, applications, and services to solve specific problems. Trove was one of the six participants in the programme, and has now secured funding from the company to assist its growth.

ARM will utilise the Trove application to offer its clients the opportunity of trading in government bonds, stocks, US Exchange- traded funds, US stocks. Clients with the ARM Stocktrade App will be able to seamlessly participate in the global economy and own shares in companies such as Facebook, Lyft, Pinterest and Zoom without the need to reside in the US or have social security numbers.

“We believe that this is a wonderful opportunity to enlarge the investment playing field for our valuable clients enabling them to trade in diverse stocks and accumulate wealth globally from the comfort of their homes. It is also our hope that this partnership will encourage more millennials to explore the world of investing in order to build a future of realised ambitions,” said ARM Financial Advisers managing director Henrietta Bankole-Olusina.