Zambian startup PremierCredit, a micro-lending platform that also has operations in Zimbabwe, has raised US$650,000 in funding from Enygma Ventures to help it scale further.

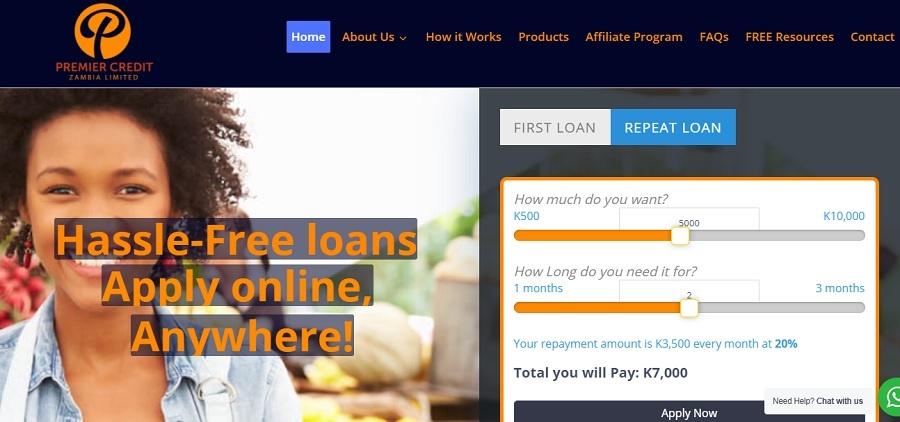

Launched in 2019, PremierCredit offers micro-loans to Zambian entrepreneurs and small scale traders, many of whom are women, increasing their access to capital and the ability to grow their businesses.

With the support of its partner bank in Zimbabwe, meanwhile, PremierCredit provides affordable bicycles, smartphones and solar equipment on a pay-as-you-go (PAYG) basis to underserved communities.

The startup now plans to grow further across the SADC region after becoming the 10th company this year to raise funding from Enygma Ventures, a ZAR100 million (US$6.8 million) fund launched late last year with a focus on investing in women entrepreneurs.

“We are extremely elated about our partnership with Enygma Ventures. The financial and strategic support will allow us to execute on our vision to service multiple countries across the region,” said Chilufya Mutale, co-founder and chief executive officer (CEO) of PremierCredit.

Sarah Dusek, managing partner and co-founder of Engyma Ventures, said after an “extraordinary year” it was “incredible” to see women-owned businesses still thriving and creating expansion plans, despite the pandemic.

“PremierCredit has a proven track record of supporting the informal sector and making informal trading possible for many by providing timely and appropriate loans to help businesses thrive,” she said.