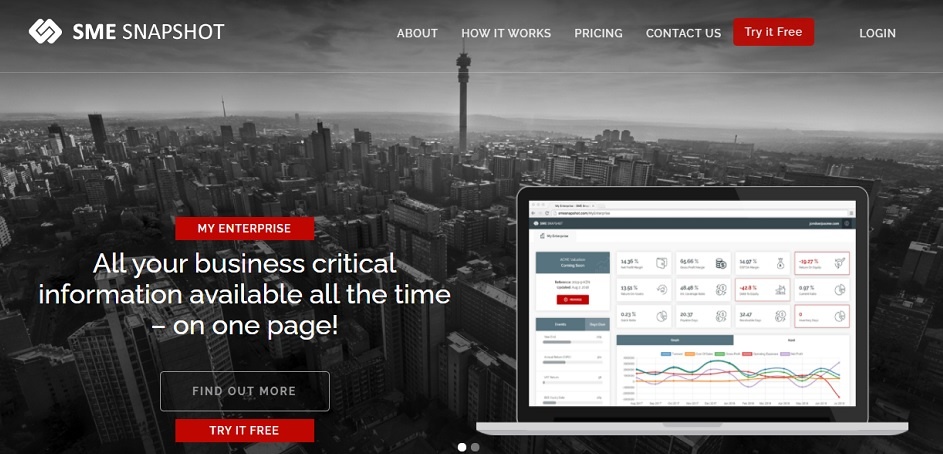

It started as an Excel document, but South African startup SME Snapshot has developed into a real-time financial analytics platform aimed at a multi-tiered market serving the interests of entrepreneurs.

Formed in 2018, with the goal of building the capacity of SMEs to update and understand financial analytics, SME Snapshot allows entrepreneurs to keep tabs on their business health metrics and receive important regulatory and statutory reminders.

Accountants, incubators and mentors use the platforms to advise their clients on the best way to grow their businesses, by having access to peer comparisons – both local and international – and live trading history. Funders, such as banks and VCs, use the platform for pipeline and to mitigate lending risks, as post-loan management can happen in real-time.

Before founding SME Snapshot, Tyronne Nel spent many years starting or buying small businesses, which he turned around and resold, while he has also worked with the likes of Edge Growth, Microsoft and LEAP. He said SME Snapshot started as an Excel pivot table, before it started building its interactive software and APIs into the online accounting platforms.

“We realised that, despite the continued cry that there was no accurate data on the SME sector, the data was in fact available,” he told Disrupt Africa. “The problem, however, was that it was decentralised into thousands of accounting offices worldwide. SME Snapshot now makes it available in a centralised easy to use platform.”

This ease of use has won it immediate uptake. So far, the startup has signed up over 500 active clients, sold the first white label version of the platform, and started building the second. It has also built a forex application for a client that integrates with the platform, and signed two reseller agreements.

All this while being self-funded, with SME Snapshot’s main income coming from monthly and annual subscriptions, as well as white label development.

Nel said as the platform is country and accounting platform agnostic, it is currently available globally.

“With this said though, we are focusing on South Africa at the moment, however two of our early adopters are pushing us into the US market which we should enter in the second half of 2021,” he said.

“Our biggest difficulty has been accessing the corporate market as we don’t have the necessary network connections. This is slowly changing as we’re gaining more traction.”