Nigerian cryptocurrency exchange Busha has raised a US$4.2 million seed funding round to scale across Africa.

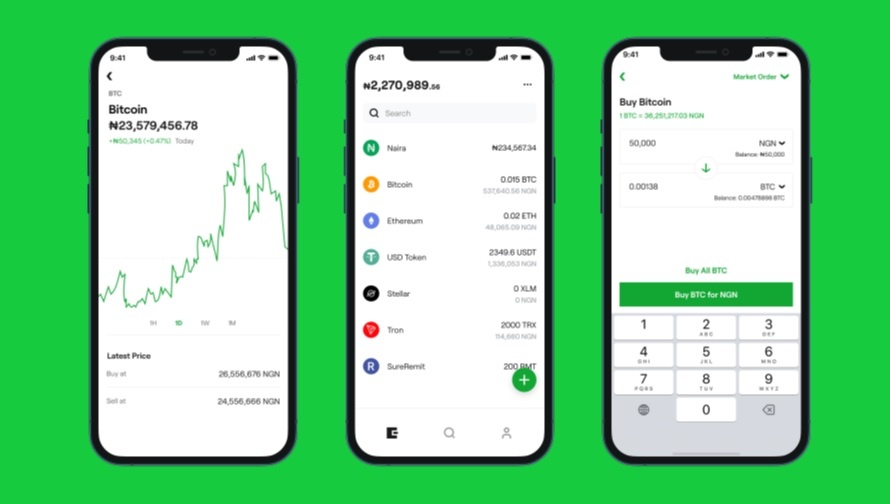

Founded in 2019, Busha allows users to buy, sell, and manage their cryptocurrency portfolios from its easy to use mobile app.

The startup has been scaling across Nigeria, and has now raised a US$4.2 million seed round to deepen its market positioning across West Africa and other regions of the continent. The round was led by Jump Capital, and also featured Cadenza Ventures, Blockwall Capital, CMT Digital, Greenhouse Capital, Raba Capital, and other investors.

“Our immediate mission is to onboard the next one million Africans into the crypto economy. We have seen the significant difference in financial freedom that crypto can make in the lives of our over 200,000 users, and we are very motivated to extend this to more people on the continent,” said Michael Adeyeri, co-founder and chief executive officer (CEO) at Busha.

The startup recently launched a revamped version of its app, with features such as minimum purchases as low as 50 cents for a more inclusive offering, one-click limit orders, and automated recurring buys.

“We pride ourselves in being first in the market to introduce tangible innovations such as instant payouts and 24/7 human customer service,” said co-founder and chief product officer Moyo Sodipo. “This funding will empower us to do more faster, improve our security, and take a definitive leadership position in our target markets.”

“We believe Nigeria and the African continent are one of the most promising places for crypto to make a significant impact in offering financial freedom to millions of individuals,” said Peter Johnson, partner at Jump Capital. “We are excited to work with the Busha team to continue to enhance their market-leading product offering.”