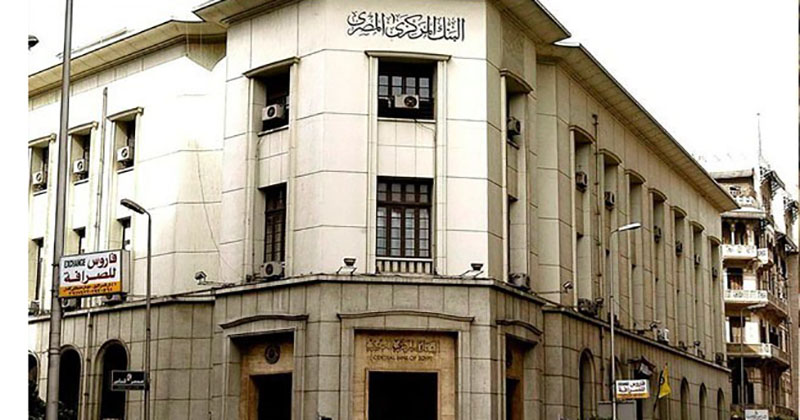

In context of the Central Bank of Egypt’s endeavors, to promote the FinTech industry and provide a full-fledged understanding of the developments witnessed in this vital sector. FinTech Egypt -an initiative powered by CBE- is releasing the first report of its kind that provides a comprehensive and holistic overview of the unprecedented growth that Egypt has witnessed in Financial Technology industry over the last few years.

The report sheds light on the local FinTech & FinTech-enabled startups and entrepreneurs; in addition to FinTech Ecosystem stakeholders such as incubators, accelerators, investors, and supporting organizations. The purpose of the report is to deliver a holistic overview of their capabilities and needs as well as identify potential areas for support, collaboration, and partnership among FinTech ecosystem stakeholders.

The report revealed that FinTech in Egypt has grown at a rapid pace over the last few years. As per the report, there has been a tremendous growth in venture capital investments over the last 5 years from around USD 1M raised in 3 FinTech deals in 2017, to reach what exceeds USD 159 M, only in 2021 with 32 FinTech deals. Investments have soared by more than 300% during only the last 12 months, indicating the development & the expansion of mature and scaled FinTech & FinTech-enabled startups.

In the same context, FinTech & FinTech-enabled startups operating in this field have been steadily growing, as they increased from only 2 startups in 2014, to reach 112 by the end of 2021, in more than 14 innovative sub-sectors as payments and remittance, B2B Marketplaces, lending and alternative finance, etc.

The report had diligently shed light on the Egyptian young calibers and talented youth across all fields, especially in FinTech. The report also indicated that the majority of Egyptian FinTech startups were established by the youth, whose ages ranged between 25 and 35 years. Moreover, the report highlighted the role played by the young talents who founded these startups, as they represent promising investments for the future towards achieving multiple benefits for the Egyptian market, as 24 startups have expanded in this field at the regional and international levels; while enjoying significant presence in the MENA region, GCC Countries, and Europe.

Mr. Rami Abulnaga, Deputy Governor of the Central Bank of Egypt, stated that: “The FinTech Landscape Report 2021 comes in line with the efforts exerted by the Central Bank to promote the FinTech industry, since the launch of its FinTech and Innovation Strategy in 2019, in accordance with the directives of H.E. President Abdel Fattah El-Sisi to achieve the digital transformation goals of the Egyptian state as part of Egypt’s Vision 2030, in light of which, the FinTech regulatory sandbox was launched, a series of market here2hear roundtable discussions was conducted to pinpoint market demand areas, and promotion of FinTech talents through dedicated educational programs”.

Eng. Ayman Hussein, First Sub-Governor of the Central Bank for the Information Technology Sector, also declared: “Efforts to endorse the FinTech industry have yielded in the creation of an optimistic future for a promising pool of Egyptian FinTech & FinTech-enabled startups and investments, which is expected to prosper in the Year 2022 by the launch of FinTech & Innovation Hub (Grid), in addition to the FinTech fund that was established by the 3 banks (National Bank of Egypt, Banque Misr, and Banque du Caire) worth of more than EGP 1.3 billion, which is aspired to become the largest FinTech focused fund in the region.”

Dr. Rasha Negm, Assistant Sub-Governor of the Central Bank for Financial Technology and Innovation, added: “This report acts as an initial step to provide a comprehensive view for all the FinTech ecosystem stakeholders in Egypt, as well as highlight the unprecedented growth that Egypt has witnessed in the field of financial technology over the last few years. This report is stemmed from surveys that included primary data received from 112 FinTech & FinTech-enabled startups, and 18 of ecosystem facilitators including incubators, accelerators, investors, and supporting organizations. This report is expected to be a catalyst for future innovation, and support for cooperation between all stakeholders of the FinTech ecosystem.”

The report is available via the following link: https://fintech-egypt.com/FinTech-Egypt-Landscape-Report/