Nigerian startup insurtech startup ETAP, which makes it easier to buy car insurance and make claims, has secured US$1.5 million in pre-seed funding to grow its team and drive the adoption of car insurance across Africa.

ETAP makes buying and claiming on car insurance as easy as taking a picture, providing drivers with access to a range of daily, weekly, monthly and quarterly plans to choose from.

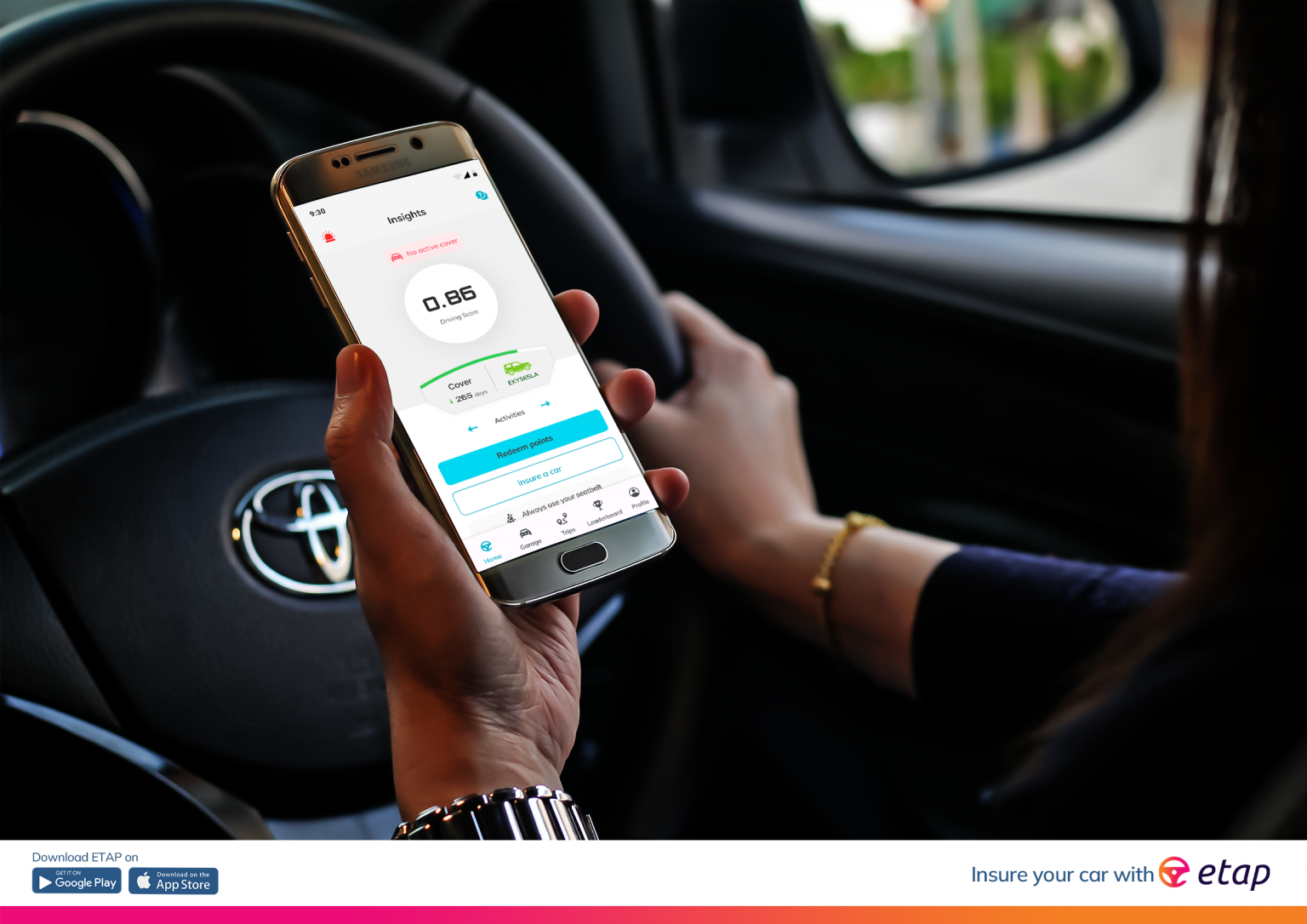

The startup uses machine learning to build intelligent risk profiles that determine appropriate premiums for each driver, allowing them to achieve lower premiums by driving safely. Using advanced telematics, the driving experience is gamified to improve driving behaviour and drivers can earn Safe Driving Points that can be exchanged for shopping vouchers for the most in-demand retail outlets, fuel, cinema and concert tickets, and other exciting experiences.

Since launching in beta in November 2021, ETAP has insured more than 130,000 individual trips and over 500,000 kilometres in car journeys, and it has now secured US$1.5 million in pre-seed funding for further growth. The round was led by Mobility 54, the venture capital arm of Toyota Tsusho and CFAO Group, with participation from Tangerine Insurance, Graph Ventures, Newmont and other angel investors.

The funding will support the rollout of ETAP’s app, which allows drivers to buy insurance in 90 seconds, complete claims in three minutes or less, and get rewarded for good driving and avoiding accidents. The startup will also explore other opportunities to deliver insurance services for car owners in other countries across the continent.

“Just like any other digital service, we believe Nigerians should be able to buy and claim car insurance without having to “call a guy”. We also believe that rewarding good drivers can be a catalyst for better driving and making our roads safer,” said Ibraheem Babalola, CEO and founder of ETAP.

“This is why we have created Africa’s most powerful car insurance app and we are excited to have raised these funds to bring more users on board. Too often, the process of buying and claiming insurance in Africa is so out of touch with the everyday reality of most people but we are changing the game and making the process just as enjoyable as any other experience that consumers access on the mobile phone.”

Yumi Takagi, project manager at Mobility 54, said ETAP was addressing many challenges that impact the automotive experience in Africa.

“We are excited to support and work with them to bring their innovation to more drivers across the continent. We believe that ETAP will engage with this important role and revolutionise the automotive insurance industry with their powerful technology,” he said.