South African fintech startup Stitch has launched LinkPay, allowing businesses in South Africa and Nigeria to enable users to link their financial accounts and pay securely via instant bank transfer, in seconds.

The Stitch API allows developers to connect apps to financial accounts within minutes, allowing their users to share their transaction histories and balances, confirm their identities, and initiate payments.

This tooling allows companies to innovate with new and improved services including personal finance, lending, insurance, payments and wealth management. Stitch also enables fintechs to work with traditional financial institutions in a safer and more compliant way.

Stitch raised a US$21 million Series A funding round earlier this year, partly for the launch of new products, and has now released LinkPay, a linked-account payments product that enables variable recurring payments.

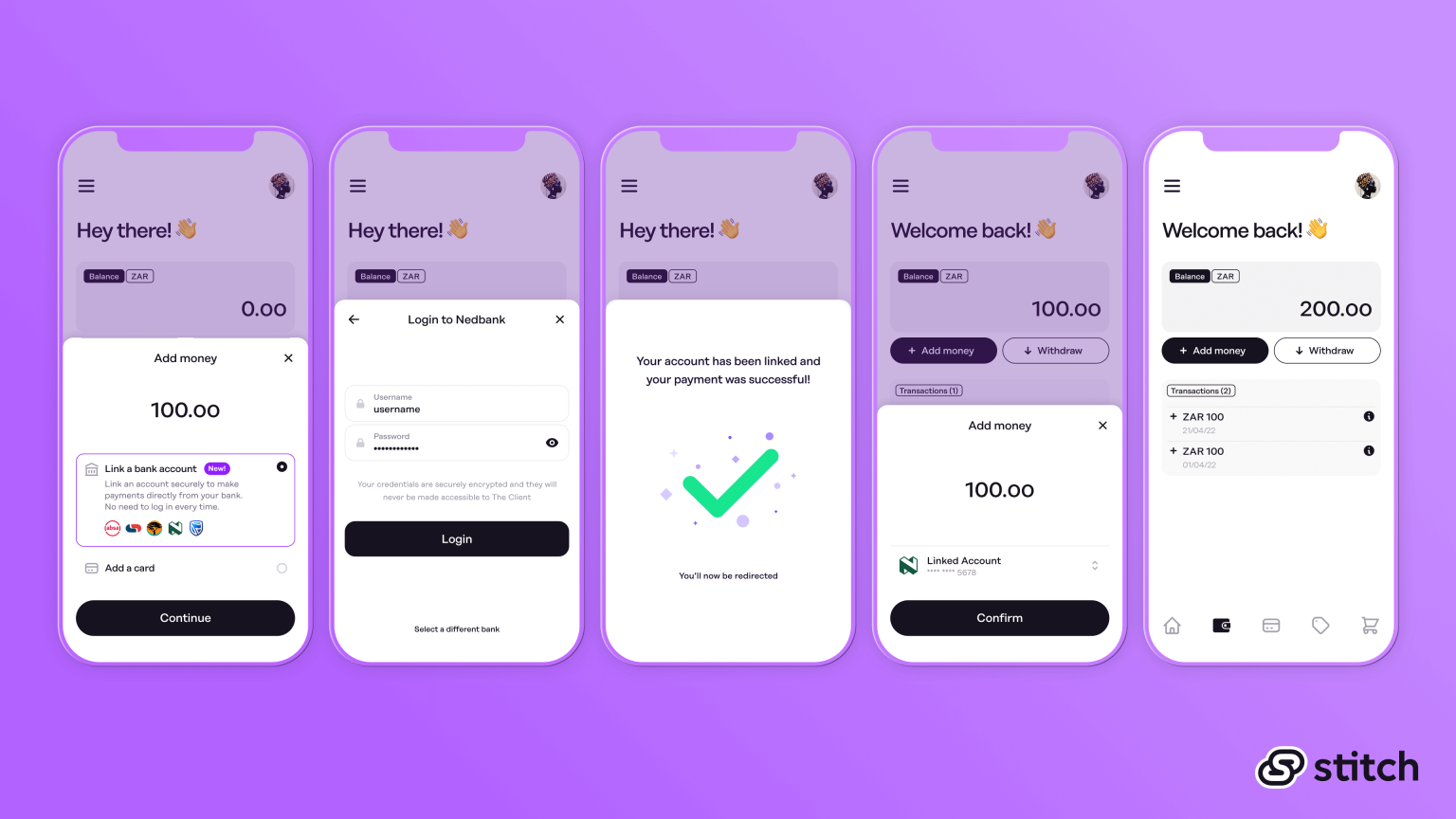

LinkPay allows businesses in South Africa and Nigeria to accept secure, one-click payments directly from a user’s financial account, making the payment experience as convenient as that of a tokenised card but without high fees or chargebacks. LinkPay can be integrated alongside Stitch payouts and financial data products to enable a complete linked-account journey, including verified payments, refunds and withdrawals.

“With LinkPay, Stitch can enable businesses to offer a more frictionless and secure payments experience, making it easier than ever for their customers to pay – and saving on costs. Combined with Stitch financial data and payouts products, LinkPay offers a truly unique closed-loop linked-account experience for returning users – from fast, seamless onboarding, to one-click payments and payouts. As a result, businesses will see higher conversion rates, a reduction in costs and ultimately a more convenient experience for their users,” said Junaid Dadan, chief product officer at Stitch.